While Intel (NASDAQ: INTC) draws attention with government support and Nvidia (NASDAQ: NVDA) dominates the AI headlines, another semiconductor giant has been quietly building scale in the background.

Broadcom (NASDAQ: AVGO) has returned 61% over the past year as of January 28, 2026, comfortably beating Nvidia over the same stretch.

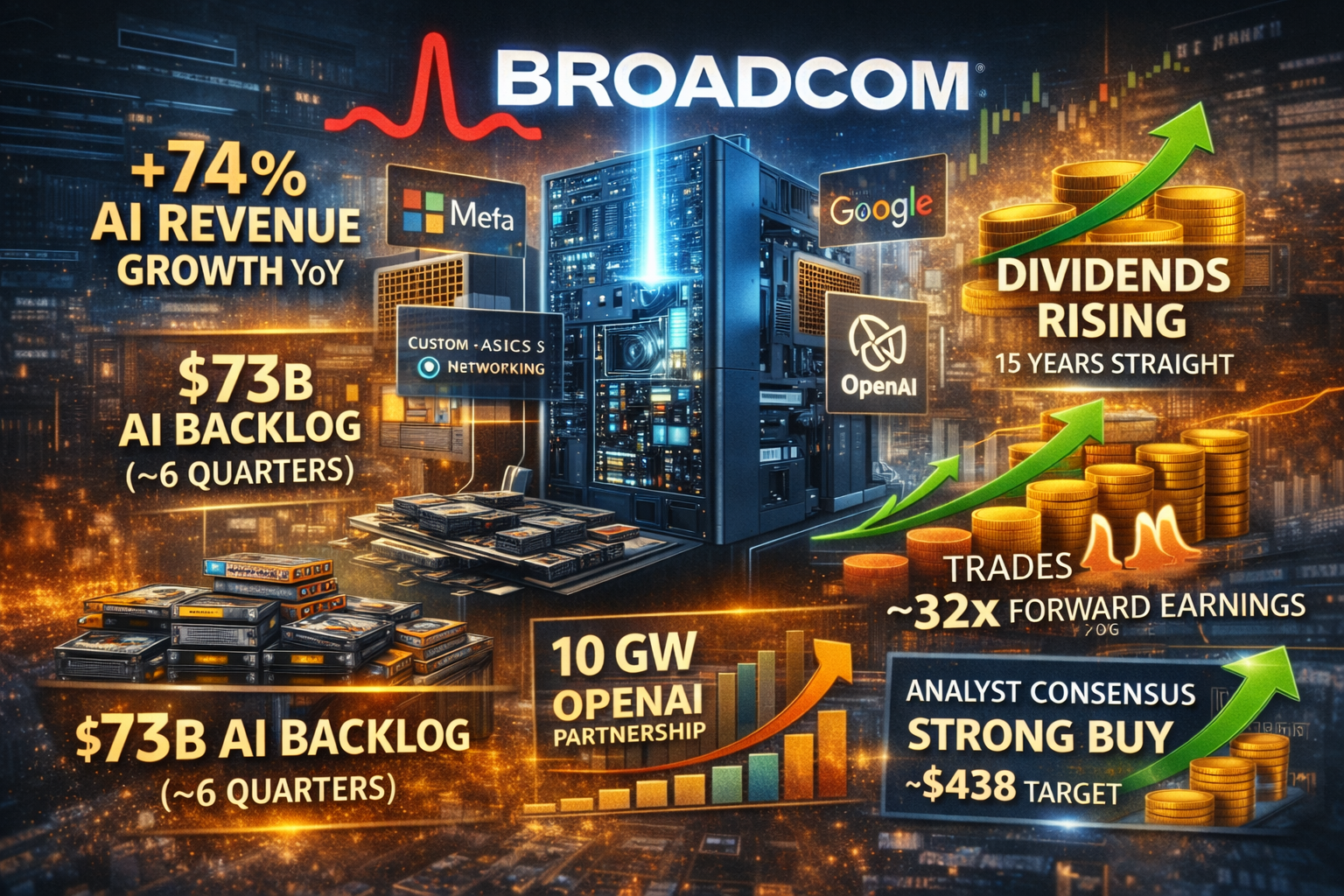

Behind that performance, AI-related revenue is ramping faster than many expected, with growth that appears close to doubling, supported by a $73 billion backlog of custom chip orders slated for delivery over the next 18 months.

Broadcom stock: The overlooked AI infrastructure play

Broadcom’s competitive advantage lies in what it does not do.

While Nvidia sells general-purpose graphics processing units (GPUs), Broadcom designs custom application-specific integrated circuits (ASICs) built exclusively for individual hyperscalers like Google, Meta, and Microsoft.

This distinction matters enormously. ASICs are engineering-tailored solutions rather than off-the-shelf products.

In high-speed Ethernet networking silicon and AI accelerator chips, Broadcom holds a commanding market position.

The financial picture validates this moat.

In its fourth quarter and full fiscal year 2025, Broadcom reported that AI-related semiconductor revenue surged approximately 74% year-over-year and now represents roughly one-third of total revenue.

Management guidance projects AI chip revenue will accelerate further, growing approximately 100% year-over-year in the coming fiscal quarter.

The $73 billion backlog of AI products represents orders to be shipped over the next six quarters, providing unusual revenue visibility for a semiconductor company.

Strategic partnerships lock in long-term demand

Broadcom’s revenue durability is anchored in long-term customer relationships that grow harder to unwind over time.

In October 2025, the company disclosed a collaboration with OpenAI to co-develop custom AI accelerators, with initial deployments slated for the second half of 2026 and rollouts extending through 2029.

The agreement amounts to a firm, multi-year commitment covering roughly 10 gigawatts of custom silicon capacity.

Google is another critical anchor customer.

Although Google designs its own TPU (Tensor Processing Unit) architecture, Broadcom provides the bespoke networking ASICs and core infrastructure silicon that tie these systems together.

Analysts often point to this setup as evidence of a structural moat, even as questions linger over how durable that infrastructure-level lock-in will ultimately prove to be.

Valuation implies meaningful upside

Broadcom currently trades at about 32 times forward earnings, broadly in line with the Nasdaq-100 average.

What stands out more is its five-year PEG ratio, which sits around 0.9. That implies investors are paying relatively less for each unit of expected earnings growth than they are across the wider market.

Analyst sentiment remains firmly positive.

As of late January 2026, 34 analysts rate the stock a “Buy,” with average 12-month price targets ranging from $436 to $455. That points to roughly 30–38% upside from current levels.

J.P. Morgan is even more bullish, assigning a $475 target based on a 32× multiple applied to projected 2026 earnings of about $15 per share.

Then there’s the dividend. Broadcom recently raised its quarterly payout to $0.65, extending its streak of annual dividend increases to 15 years.

The yield, at around 0.8%, isn’t eye-catching, but the consistency of those increases can compound meaningfully for long-term investors.

And while Wall Street’s attention remains fixed on Nvidia and Intel, Broadcom is quietly embedded at the core of hyperscaler infrastructure spending, with revenue visibility stretching out to 2029.

The post Could this high-dividend chip stock be Wall Street’s smartest bet? appeared first on Invezz