Rising competition, new tariffs, brand crisis, and fears of a recession ahead – there’s not much that is particularly going well for Tesla Inc (NASDAQ: TSLA) in 2025.

Still, influential investor Cathie Wood remains super bullish on the EV stock that she believes will hit $2,600 before the end of this decade.

However, her recent purchase was not of TSLA. Instead, the founder and chief executive of Ark Invest parked more than $9.0 million in another “Magnificent 7” stock on April 4.

Enter Amazon.com Inc (NASDAQ: AMZN).

How much did Cathie Wood invest in Amazon stock?

Wood spent $9.3 million to load up on more than 54,000 shares of Amazon on April 4, indicating she reads a 30% decline in AMZN as an opportunity to buy a quality name at a deep discount.

The famed investor remains positive on Amazon stock as the Seattle headquartered giant has been investing rather aggressively to expand its footprint in artificial intelligence.

Other than its continued engagement with Anthropic, the tech titan has recently launched Alexa+.

Alexa+ is the firm’s upgraded AI assistant capable of managing smart home devices, ordering food online, and handling a whole bunch of other tasks.

Investing in AI is broadly expected to help Amazon diversify its revenue beyond retail and cloud.

AMZN is trading at an attractive valuation

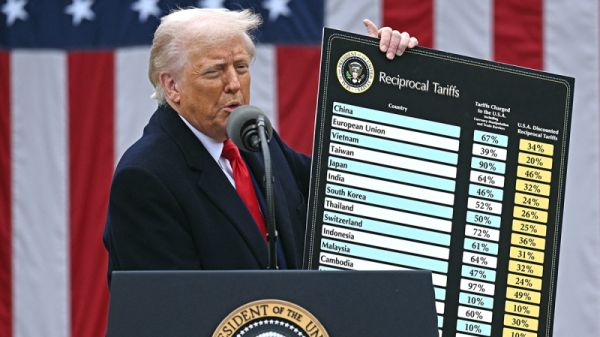

Wood has confidence in Amazon’s ability to tap into its global scale and diversified revenue stream to navigate the trade war that’s emerging in response to Trump’s new tariffs.

Additionally, the valuation tied to the tech stock is far too attractive to ignore at writing.

AMZN is currently going for only 30 times its estimated next year’s earnings, sharply below its historical average of about 55.

Wall Street seems to agree with Cathie Wood on Amazon stock.

The consensus rating on AMZN currently sits at “buy” with the mean target of $267, indicating potential upside of well over 50% from here.

Why I disagree with Wood’s view on TSLA shares

Cathie Wood may have been right or at least practical with her investment in Amazon stock, but her call for TSLA hitting $2,600 within the next five years sounds more like a daydream, at least for now.

That’s because Tesla is currently struggling with a delivery slowdown amidst rising competition from its Chinese rivals.

Plus, the EV maker has been a laggard in launching new products as well.

In 2024, the multinational based out of Austin, Texas, saw its net income crash an alarming 52%, and the weakness is broadly expected to persist this year.

That makes Tesla a low-growth company that’s still trading at an unreasonable price-to-earnings multiple of about 117 at writing.

If anything, TSLA’s current valuation suggests the EV stock could tumble further from here, instead of climbing to the $10 trillion valuation as Wood forecasts.

The post Cathie Wood says Tesla will hit $2,600, but invests $9M in a different Magnificent 7 stock appeared first on Invezz