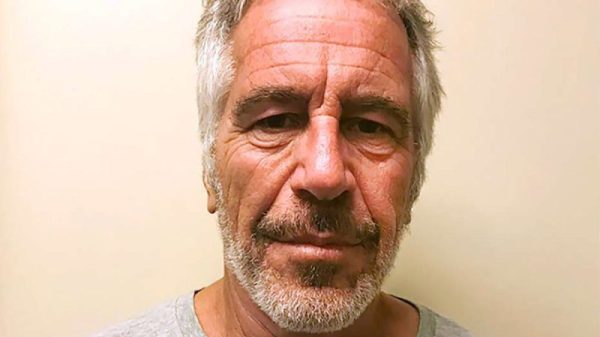

White House economic adviser Kevin Hassett has thrust himself into the center of Wall Street’s biggest guessing game, telling Fox News on Sunday he’d be “happy to serve” if tapped to lead the Federal Reserve.

His public show of readiness instantly shifted betting odds, pushed Treasury yields lower, and signaled that President Donald Trump’s long-awaited Fed-chair decision may be just days away.

Hassett’s willingness to accept the role follows Bloomberg reporting last week that identified him as the frontrunner among Trump’s inner circle, and coincides with Trump’s own confirmation aboard Air Force One that he has already made his choice.

Prediction markets reacted sharply: Hassett’s odds on Kalshi surged from 55% to 76% within hours, while the 10-year Treasury yield briefly dipped to 4%, its lowest level in a month.

The timing is unusually tight. Jerome Powell’s four-year term as chair expires in May 2026, though he could remain on the Board of Governors until January 2028.

Kevin Hassett speaks: Signals, subtext and the White House playbook

Hassett’s carefully crafted language on Sunday morning talk shows offered more than polite deference. On Fox, he framed his readiness not as ambition but as duty: “If he picks me, I’ll be happy to serve”.

On CBS’s Face the Nation, he pivoted away from speculation about his own candidacy, instead highlighting the market’s positive response to the expectation of Trump’s forthcoming announcement.

“Interest rates went down. We had one of our best Treasury auctions ever,” he told CBS, casting himself as both a steady hand and a signal that lower borrowing costs are coming.

That framing is deliberate, as Kevin Hassett is known to be closely aligned with Trump’s pro-growth, rate-cutting instincts.

By pointing to the market’s enthusiastic reaction, he was subtly countering fears that he would be too politically pliant or unable to unite the Fed’s often-fractious rate-setting committee.

The subtext was unmistakable: the president trusts him, the markets approve, and the White House playbook is to move quickly.

Trump’s own rhetoric reinforces the urgency.

Speaking to reporters on Air Force One, he declared, “I know who I am going to pick, yeah. We’ll be announcing it,” a confirmation that stops short of naming Hassett but effectively ends months of public speculation.

Market reaction: Yields, dollars and the betting markets

Financial markets are already repricing around Hassett. The 10-year Treasury yield fell to 4% for the first time in a month, a drop that Bloomberg attributed directly to the news that Hassett had emerged as the frontrunner.

Traders are watching key datapoints to gauge the Fed’s next move: Treasury yields, Fed funds futures, and the dollar’s trajectory against major currencies all serve as real-time barometers of policy expectations.

Official White House announcement expected before December 25; watch for comments from Treasury and Fed officials, Treasury yield movements, and Fed funds futures pricing ahead of the December 9–10 FOMC meeting.

The post Trump’s surprise Fed pick? Kevin Hassett hints markets are bracing for a big shakeup appeared first on Invezz