Asian markets delivered a mixed performance on Tuesday, with investors balancing optimism around Chinese policy support against growing concerns over a potential US government shutdown.

Unless lawmakers reach a funding deal by midnight local time, the US faces a closure that could delay key economic data releases, including September employment figures, construction spending, and August trade data.

Analysts at Bank of America noted that a prolonged closure could leave the Federal Reserve “flying blind” when it meets on October 29.

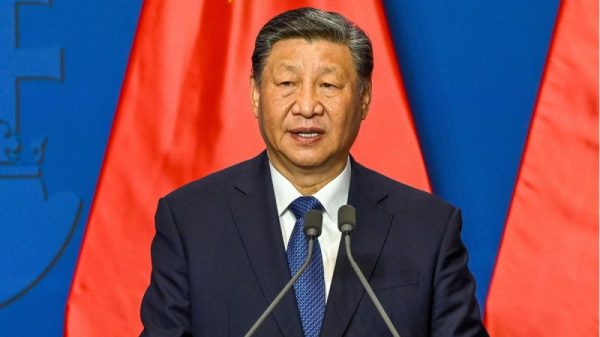

China and Hong Kong advance on stimulus bets

China’s Shanghai Composite Index rose 0.52 percent to 3,882.78 as investors awaited further stimulus to lift domestic demand and monitored developments on trade negotiations with the US.

Fresh data provided mixed signals: the official manufacturing Purchasing Managers’ Index climbed to 49.8 in September from 49.4, hitting a six-month high, while non-manufacturing PMI slipped to neutral levels.

A private PMI survey painted a more upbeat picture, showing stronger-than-expected growth in both manufacturing and services activity.

Hong Kong stocks gained ahead of a holiday break, supported by hopes of government stimulus measures despite subdued factory data from China.

The Hang Seng Index rose 0.9 percent to 26,855.56, extending Monday’s 1.9 percent advance, while the Hang Seng Tech Index added 2.2 percent.

Notable gainers included pharmaceutical firm WuXi AppTec, up 8.1 percent to HK$118.70, e-commerce giant Alibaba Group Holding, which added 2.1 percent to HK$177, and NetEase, which rose 2.1 percent to HK$236.80.

Electric-vehicle maker Li Auto climbed 2.9 percent to HK$101.40, and Semiconductor Manufacturing International gained 4 percent to HK$79.55 after reports suggested Huawei Technologies would double output of its artificial intelligence chips.

Japanese shares slip amid policy debate

Japan’s equity markets edged lower after minutes from the Bank of Japan’s September policy meeting revealed board members had discussed the feasibility of raising interest rates in the near term.

Investors were also cautious ahead of half-yearly portfolio rebalancing and the upcoming Liberal Democratic Party leadership election, while weak industrial output and retail sales figures weighed further on sentiment.

The Nikkei 225 fell 0.25 percent to 44,932.63, while the broader Topix managed a 0.19 percent gain to 3,137.60.

Technology shares dragged on the market, with Advantest down 3.3 percent and SoftBank Group losing 1.9 percent.

Other regional markets

In South Korea, the Kospi slipped 0.19 percent to close at 3,424.60.

Earlier data showed industrial production rose 2.4 percent month-on-month in August, marking the strongest increase in five months.

Australian stocks also ended weaker as the Reserve Bank of Australia left interest rates unchanged, as widely expected, but struck a cautious tone on its policy outlook.

The S&P/ASX 200 declined 0.16 percent to 8,848.80, with financial and energy shares leading losses.

The post Asian stocks end mixed on Tuesday: Hang Seng up 0.9%, Nikkei down 0.25% appeared first on Invezz