Global remittances are expected to exceed $800 billion this year, driven by rapid innovation in cross-border payment infrastructure, particularly in emerging economies.

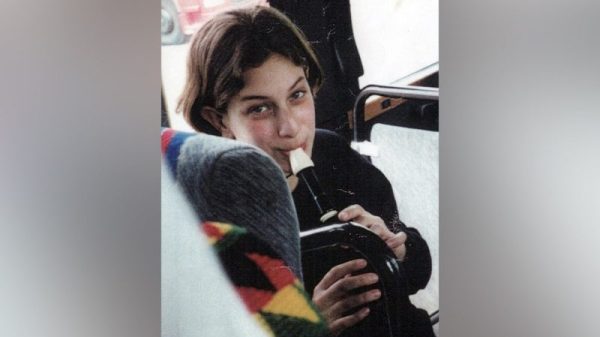

Ollie Walsh, President of Qenta and former Co-Founder of Pipit Global, a cash-to-digital platform that created one of the world’s largest payment networks, is at the heart of this revolution.

Walsh was the CEO of Terraforma, the company behind Pipit Global, and is the president of Qenta.

He has twenty years of experience developing strategies for start-ups and SMEs to target new markets and to grow.

He specialises in building teams and implementing plans, and making them work. Ollie holds an MBS from the National University of Ireland, Galway.

Ollie Walsh now oversees Qenta’s global plan to develop safe, blockchain-enabled financial services in underserved regions, which includes over 1 million cash pay-in points, integration with 300 million mobile wallets, and a presence in over 45 countries.

In an exclusive interview with Invezz, Walsh discussed Qenta’s post-acquisition strategy, how lessons from Sub-Saharan Africa’s mobile money boom are shaping efforts in Latin America, and why addressing cash access remains critical.

Wlash also explained how Qenta combines old infrastructure with modern technology, not to pursue crypto trends, but to provide genuine financial inclusion where it is most needed.

Qenta’s strategy post-acquisition

As the fintech market evolves, Qenta is refining its goal and expanding its global footprint, particularly since acquiring Pipit Global earlier this year.

Invezz: Can you give us a brief overview of Qenta’s mission and how the recent acquisition of Pipit Global fits into that strategy?

Qenta is a pioneering fintech division, strategically bridging legacy financial systems and modern digital and blockchain solutions.

Formerly the primary brand of the ecosystem, Qenta is now focused specifically on global payments following its acquisition of Pipit.

Qenta specialises in extensive remittance networks and migrant services across Africa, Latin America, and Europe, facilitating cash, mobile money, Alternative Payment Methods (APMs) and bank transactions in over 50 countries.

By integrating regional payment infrastructures with blockchain technology, Qenta significantly enhances financial inclusion and transaction efficiency.

Qenta’s mission is to democratize access to modern financial services by delivering secure, compliant, and scalable fintech solutions tailored to the needs of underserved and migrant populations.

Through innovative technology, strategic partnerships, and deep regional expertise, Qenta is committed to empowering businesses and individuals by providing efficient cross-border financial capabilities.

Tackling friction in cross-border payments

Despite rising demand, cross-border payments remain slow and expensive, especially for migrants and those without access to conventional banking.

Invezz: What are the most pressing challenges Qenta is aiming to solve in the cross-border payments space, particularly in underserved markets?

Traditional cross-border payment systems are often slow, expensive, and inaccessible, particularly for migrants and underserved populations lacking formal banking access.

Issues such as high transaction fees, limited access to traditional banking services, and complex compliance requirements significantly hinder economic participation and financial inclusion.

Qenta addresses these challenges by providing seamless integration with localised payment systems and leveraging blockchain technology for improved transparency, reduced costs, and increased transaction speed.

Lessons from Africa’s mobile money boom

Sub-Saharan Africa has emerged as a global leader in mobile money uptake. Qenta plans to apply what it has learned elsewhere.

Invezz: Mobile money has seen explosive growth in Sub-Saharan Africa. How do you see that momentum translating—or not—to Latin America?

Qenta’s remittance and migrant service networks already span both Sub-Saharan Africa and Latin America, with operations tailored to local infrastructure.

By integrating regional payment systems with blockchain technology, Qenta applies lessons from mobile money adoption in Africa to improve financial inclusion and transaction efficiency in Latin America as well.

Expanding across Latin America

With activities currently underway in numerous Latin American nations, Qenta is actively developing infrastructure and partnerships for expansion.

Invezz: Which Latin American countries are currently your main focus, and what kinds of partnerships or infrastructure are you building in the region?

Currently, our main markets are Mexico, Brazil and Peru, where we are processing cash and local APMs.

However, we have rolled out our payment capabilities across most of LatAm and are now working with merchants to roll out payment services.

Cash, trust, and digital access

In many emerging markets, cash reigns supreme—and trust in formal banking systems is low. Qenta confronts the reality full on.

Invezz: How does Qenta approach financial inclusion in areas where cash is still dominant and trust in traditional banking systems is low?

Qenta addresses these challenges by integrating with localised payment systems and using blockchain to improve transparency, reduce costs, and increase transaction speed.

The platform supports cash, mobile money, APMs, and bank transactions across over 45 countries, aiming to make financial services more accessible for underserved and migrant populations.

With our cash model, we ‘digitise cash’ by enabling people to top up e-wallets, mobile money accounts, as well as making bill and e-commerce payments through our bespoke payments system.

Put simply, the customer generates a bar code on a digital platform and can pay with that code in a local shop or agent. In our cash countries, anywhere a mobile phone can be topped up, we can process a cash payment.

Rethinking remittances

With remittances to Latin America at all-time highs, Qenta sees a significant opportunity to change how money flows across borders.

Invezz: With remittances to Latin America reaching record highs, how is Qenta positioning itself to improve the way migrants send and families receive money across borders?

Qenta focuses on enhancing cross-border financial capabilities by combining regional payment infrastructure with blockchain.

This approach reduces the inefficiencies of traditional remittance channels, offering migrants and their families faster, more secure, and lower-cost ways to send and receive money across borders.

The post Interview: Qenta President Ollie Walsh on remittances, blockchain, and boosting financial inclusion in LATAM appeared first on Invezz