April witnessed some extraordinary market moves.

Not just in US equities, but across bond markets as well.

Summarising market movements triggered by President Trump’s tariffs, on the last day of April, the NASDAQ was still trading around levels seen just before Mr Trump listed out his reciprocal tariffs on ‘Liberation Day’ at the beginning of the month. That is quite an achievement.

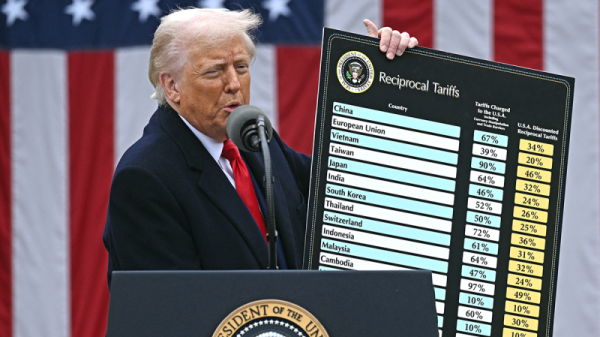

Trump’s tariff rates were far above anything the market had prepared for (suggesting, perhaps, that the Treasury is far less leaky than the Defence Department), and investors reacted accordingly.

This saw the NASDAQ 100 lose over 17% between Wednesday night and Monday.

Before this, the NASDAQ was already in reverse gear, having dropped 12% from its record high in late February.

The bloom had certainly come off the rally that greeted Trump’s election victory in early November.

But, in a move foreshadowed by President Trump’s actions during his first term, it didn’t take long for him to row back on most of his tariff threats.

Just one week after Liberation Day, the president postponed all tariffs, save a flat 10% levy on US imports, for ninety days (we’re just about one third of the way through the postponement).

The big exception was China. Mr Trump upped levies on Chinese imports to 145%, and China responded with 125% tariffs on the US.

Since then, the Trump administration has been petitioned by major companies such as Apple, and exemptions have been forthcoming.

Investors cheered this apparent softening from the administration.

They were so pleased by this, as well as the president insisting that he had ‘no intention’ of sacking Jerome Powell as Chair of the US Federal Reserve, that they rushed back to hoover up battered equities, leading to a one-day gain in the NASDAQ 100 of over 13%.

Since then, there have been some wild stock market sessions.

Yet equities appeared to be steadying at higher levels.

As noted earlier, the NASDAQ and S&P 500 were pretty much unchanged from pre-tariff levels.

This led many observers to say that the worst is over, particularly as the Trump administration insists that deals are on the table, intimating, yet not stating outright, that India, Japan, and the European Union were all contenders to be first to the finishing line.

The trouble is that a huge amount of damage has already been done, and arguably, risk markets are only just pricing this in.

On the last trading day of the month, Advance GDP for the first quarter dropped by 0.3% annualised, below the +0.2% expected and miles away from the prior quarter’s +2.4%.

There was also an unexpectedly large decline in ADP Payrolls, with the official Non-Farm Payroll release still two days away.

Fortunately, there was a welcome drop in Core PCE, the Fed’s preferred inflation measure.

But the trouble is that tariffs have barely started, suggesting that there could be significant weakness in US economic data over the coming months.

And that won’t reverse quickly, even if Trump cancelled all tariffs immediately.

Supply chains have been torn apart, with freight workers and others at West Coast ports already being laid off.

Container ships from China languish anywhere but near the US coastline.

While the Dow Jones Industrial Average is down around 10% from all-time highs, the Transportation Average, an old but important measure of economic activity, has lost 24%.

Trade between the US and China is in a state of suspended animation, and that looks likely to put the former into recession.

Add in the current earnings season, with companies unwilling, or unable, to provide forward guidance (and when they do, it’s negative), and things look grim economically.

That’s not to say US equities are about to tank again.

The stock market and the economy are two different things.

But if US companies feel unable to pass on their tariff costs to consumers, then that will compress profit margins.

In that case, valuations will come under considerable scrutiny.

Expect volatility to pick up again.

If there’s one positive thing to come out of President Trump’s first 100 days, it’s that these have been good times for traders, even as they prove terrible for investors.

(David Morrison is a Senior Market Analyst at Trade Nation. Views are his own.)

The post The cruellest month appeared first on Invezz