Waymo, the autonomous vehicle segment of Alphabet Inc (NASDAQ: GOOGL), says it’s now completing about a quarter-million rides per week in the US.

The startup has even partnered with Uber in Austin and Atlanta to expand its reach.

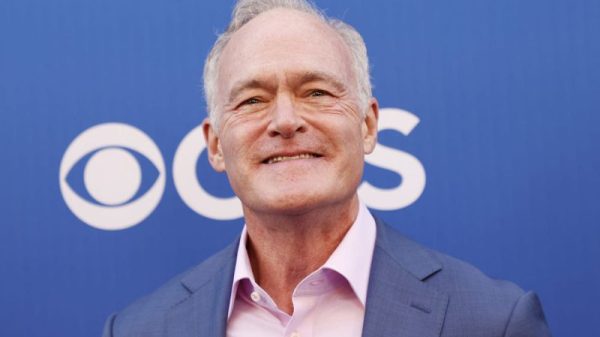

Still, famed investor Jim Cramer’s pick for exposure to robotaxis is Tesla Inc (NASDAQ: TSLA).

“I’m putting my chips on Musk,” he said last week on CNBC’s “Squawk on the Street”.

Tesla is expected to conduct a pilot launch of its robotaxi network in Austin, Texas, in June 2025.

Ahead of it, TSLA shares are down well over 30% versus their year-to-date high in January.

Pichai’s vision for Waymo beyond 2025

Cramer prefers Tesla Inc over Waymo for robotaxi exposure as the latter, he’s concerned, may not scale as many believe it would.

However, on the conference call with analysts last week, Alphabet chief executive Sundar Pichai confirmed that Waymo is working on “building a network of partners for maintaining fleets of vehicles and doing all operations.

Plus, “there’s future optionality around personal ownership” as well, he added, which puts Waymo in direct competition with billionaire Elon Musk and his commitment to fully autonomous Teslas.

Still, former hedge fund manager Jim Cramer sees TSLA as a better bet on robotaxis than Waymo.

Why Cramer prefers Tesla over Waymo

Cramer likes Tesla more for robotaxi exposure primarily because it uses a different technology for self-driving than Waymo.

Waymo relies heavily on LiDAR, radar, and high-resolution cameras to create a detailed 3D map of its surroundings.

Tesla, on the other hand, focuses on a vision-based system using cameras and neural networks.

Jim Cramer prefers the latter technology over LiDAR simply because “Elon Musk says it’s too expensive. He doesn’t like that technology, and I never go against Musk when it comes to tech.”

Note that Tesla plans on using modified Model Y vehicles for robotaxi operations.

The futuristic Cybercab is expected to join the network in 2026.

Is Google stock worth owning in 2025?

Jim Cramer’s remarks arrive only a day after Alphabet Inc, the parent company of Google, reported its financial results for the first quarter that handily topped Street estimates.

The titan’s earnings release made several Wall Street firms raise their price targets on GOOGL shares.

JPMorgan, for example, sees upside in Google stock to $195 now, indicating potential upside of nearly 20% from current levels.

Following the multinational’s earnings call, JPM analyst told clients:

We come away incrementally positive that: 1) Google is maintaining solid search monetisation despite growing LLM competition; and 2) Google has additional cost levers to help offset increasing depreciation.

Plus, GOOGL is a dividend stock that currently yields 0.49%, which makes it even more attractive to own in 2025.

The post Cramer reveals his top pick for robotaxi exposure and it’s not Waymo appeared first on Invezz