BTC price trades close to $95k with an expectation of $100K retest soon. Meanwhile, Norges Bank Investment Management reported Q1 loss of $40 billion on Thursday after the firm embraced “safe” US tech stocks while considering Bitcoin (BTC) as “risky.”

BTC Price Pauses Before $100K Revisit as Soverign Wealth Fund Reports $40B Loss

In the past five days, Bitcoin price has soared nearly 14% and tagged $95.6k. Although BTC has paused its ascent, it is likely to hit $100K soon if the bullish momentum continues.

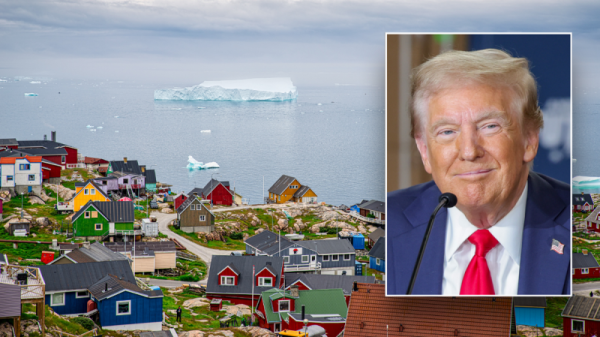

Norges Bank Investment Management that manages $1,800 billion reported $40 billion loss in a Thursday filing. Eli Nagar, the CEO of Braiins Mining, pointed out the irony as the “wealth fund didn’t want to invest in Bitcoin” due to its volatility and tagged it as “too risky.”

Instead the fund invested heavily in “safe” tech equities. According to CNBC, the firms has invested 55% of its fund in United States, including tech giants like Nvidia, Alphabet, Meta, Amazon and so on.

However, investors should note that the fund has indirect exposure to cryptocurrency markets, especially Bitcoin via companies Strategy (MicroStartegy), Coinbase, Metaplanet, and so on.

BTC Price Analysis: Is $100K Next for Bitcoin?

BTC’s value today hovers around $94,552 after closing Friday on a positive note. The four-hour chart highlights Bitcoin’s price escape from a previous value area, extending from $81k to $88.4k. This uptrend has pushed BTC price into the three-month consolidation area, stretching from $93k to $102.5k. There might be a sustained consolidation over the weekend amid Trump’s tariff pause. The push into this value area indicates that the bulls are in control, but a closer look shows they may be losing steam.

The Relative Strength Index (RSI) is in the overbought zone and has produced lower highs, diverging with BTC price’s higher highs. This nonconformity is termed bearish divergence and often leads to corrections. The same divergence can be noted on the Awesome Oscillator (AO).

However, Bitcoin price might not correct soon and could produce another higher high while the RSI & AO produce another lower high. This move will extend the bearish divergence and push BTC into a key reversal zone, extending from $97.1k to $98.1k.

Investors looking to short can expect an opportunity here. In some cases, a volatility driven spike to $100K is also possible, so traders must exercise caution in this area.

While the short-to-mid term timeframe is slightly bearish, investors can expect a bullish Bitcoin price prediction with a sustained move to $102k followed by $108k if $98k to $100k is flipped.

The post BTC Price Close to $100K as Soverign Fund that Rejected Bitcoin Reports $40B Loss appeared first on CoinGape.