There are times when the price action of a stock is worth analyzing further. This article is a follow-up to last week’s StockCharts Technical Rank (SCTR) Report pick, Palantir Technologies (PLTR). The stock sold off significantly on Monday, and, in the blog post, I mentioned that I would buy PLTR if the stock price pulled back and reversed. I used the 15-day exponential moving average (EMA) as a support level, but was willing to tighten it if necessary.

There are times when the price action of a stock is worth analyzing further. This article is a follow-up to last week’s StockCharts Technical Rank (SCTR) Report pick, Palantir Technologies (PLTR). The stock sold off significantly on Monday, and, in the blog post, I mentioned that I would buy PLTR if the stock price pulled back and reversed. I used the 15-day exponential moving average (EMA) as a support level, but was willing to tighten it if necessary.

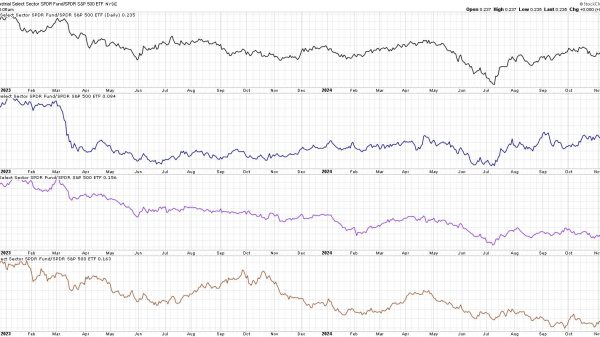

It just so happened that PLTR sold off on Monday, after which I monitored the stock closely. Monday’s low reached the low of the previous five trading days and bounced from there (blue dashed horizontal line in the chart below). That level aligns with the 10-day EMA. On the daily chart, the last three candlestick bars have relatively large price ranges. The last bar shows more buying pressure. Is PLTR showing signs of moving higher? To answer this question, you need to look at the indicators.

FIGURE 1. DAILY CHART OF PALANTIR STOCK. After hitting a high on November 15, PLTR pulled back to the lows of the last few trading days (blue dashed line). This aligns with the 10-day exponential moving average.Chart source: StockCharts.com. For educational purposes.

The SCTR score remains at a high 99.5, indicating the stock is technically strong. Let’s turn to the other conditions for entering a long position in PLTR.

- Volume. The total trading volume is insufficient to convince me the upward price move will be sustained.

- Momentum. The relative strength index (RSI) is weakening, although slightly above 70.

- Overbought/oversold. The full stochastic oscillator remains in overbought territory, although the %K and %D lines have converged and are at similar levels.

On Tuesday, PLTR sold off in early trading along with the rest of the broader indexes. However, once things started to turn around, PLTR’s stock price rose, closing at $62.98. The price action doesn’t confirm a buy as of Tuesday’s close, although that could change tomorrow.

The Game Plan

- If PLTR has upside momentum on Wednesday morning, with high volume, a rising RSI, and the stochastic in overbought territory, I will enter a long position. I’d use the support of the 10-day EMA as a stop loss level and exit the position if price crosses below the EMA.

- If price doesn’t move much on Wednesday, I’d wait patiently for the opportune entry point.

- If price shows downside movement (i.e. PLTR closes below the 10-day EMA or horizontal dashed blue line, the RSI and stochastic turn lower), I’d keep PLTR in my ChartList but revisit it later. Given that it is an AI-related stock that is actively traded, it’s not worth dismissing the stock.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.