Romina Boccia and Dominik Lett

As Congress reconvenes post-election, a critical agenda item is likely to be an emergency funding request to replenish disaster relief funds in the wake of Hurricanes Helene and Milton. With the Federal Emergency Management Agency’s (FEMA) Disaster Relief Fund expected to run dry soon and the Small Business Administration’s disaster loans already exhausted, calls for a multi-billion-dollar emergency package are circulating. But this cycle—reacting to each crisis with ever-larger disaster relief bills, often loaded with politically motivated add-ons—is unsustainable, especially given America’s precarious fiscal outlook.

A more sustainable approach to disaster aid would pair relief with responsible fiscal reforms, including offsetting new spending with cuts elsewhere and discouraging development in high-risk areas through more accurate risk-based insurance pricing.

The Current Approach to Disaster Relief

The current disaster response process is reactionary, leading to rushed emergency supplementals often packed with unrelated priorities. Since 1992, Congress has designated $12 trillion as emergency-related spending. To prevent unnecessary additions to this total, Congress should keep any upcoming supplemental focused solely on urgent relief for Hurricanes Helene and Milton, avoiding the common pitfall of including unrelated spending. Taxpayers for Common Sense, for instance, warns that a relief package padded with nonessential add-ons could exceed $100 billion. Emergency aid should not become a catch-all for special interests or extraneous projects that exploit crises for financial gain.

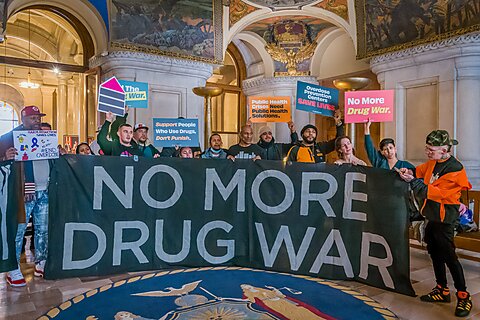

Moreover, the existing federal disaster relief framework creates a moral hazard by incentivizing development in high-risk areas, subsidized by taxpayers who would not otherwise bear these costs. The National Flood Insurance Program (NFIP) exemplifies this problem. By providing flood insurance at subsidized rates, the NFIP encourages development in flood-prone areas by shifting the financial risk from property owners to taxpayers. This misalignment of incentives leads to escalating costs and repeated bailouts, undermining disaster preparedness and fiscal responsibility.

Privatize the National Flood Insurance Program

Congress has an opportunity—and a responsibility—to rethink federal disaster relief and implement forward-looking measures to restrain emergency spending. One key reform is transitioning to a fully private flood insurance market, coupled with targeted, means-tested subsidies. Allowing the market to set risk-based premiums would better align costs with actual risks, incentivize safer development, and minimize taxpayer burdens. The inclusion of targeted, means-tested subsidies would ensure vulnerable populations are not left without relief while also being less regressive than the current system, which disproportionately benefits wealthier households that choose to live in high-risk areas.

Addressing the NFIP’s shortcomings would also reduce the geographic redistribution of resources, wherein tax dollars are extracted from inland states and sent to a handful of coastal states. Per FEMA, just five states (California, Florida, Texas, Louisiana, and New York) and two territories (Puerto Rico and the Virgin Islands) account for nearly three-quarters of the Disaster Relief Fund’s catastrophic obligations to date. Encouraging responsible development and accurate risk assessment would make federal disaster aid more equitable and fiscally sustainable.

Offset New Emergency Spending

If Congress determines that a supplemental package is necessary to respond to Hurricanes Helene and Milton, it should avoid the temptation to include unnecessary and expensive plus-ups and side deals. Better yet, Congress should offset as much of the new spending as possible with spending cuts elsewhere. For example, Congress could prohibit FEMA from obligating further funding for outdated disasters or for programs unrelated to immediate disaster relief, such as COVID-19 funding that FEMA projected would account for $22 billion in obligations between 2025 and 2028.

Reorienting FEMA’s priorities to focus on immediate and medium-term needs would also enhance efficiency. Currently, old disasters make up a significant chunk of FEMA’s yearly budget. Between 2025 and 2028, for example, FEMA projected spending $156 million on Hurricanes Katrina, Rita, and Wilma from 2005. As disasters and disaster designations proliferate, the number of emergencies on FEMA’s plate will grow, as will annual spending needs. Accordingly, FEMA will be better able to manage current emergencies without overextending its resources if it narrows its focus. At a minimum, recurring disaster relief spending on old emergencies should have to compete with other spending priorities under spending caps.

Pair Relief with Budget Reform

To enhance future fiscal restraint over emergency spending, Congress should pair any new emergency relief funding with procedural budget reforms. See this one-pager for a set of commonsense budget reforms that would improve the budget process and promote more responsible fiscal planning.

Key recommendations include:

- Offset emergency spending by implementing a mechanism to offset new emergency expenditures with spending cuts elsewhere, promoting fiscal responsibility and encouraging forward-thinking budget planning.

- Raise voting thresholds for emergency spending to increase the number of votes required to approve new emergency spending, deterring misuse and ensuring bipartisan consensus.

- Limit executive emergency declarations by restricting presidential emergency declarations to 30 days unless extended by Congress, preventing emergency spending abuse without legislative oversight.

- Enhance transparency by requiring public reporting on executive emergency expenditures, allowing taxpayers and legislators to see how funds are used during emergencies.

- Correct budget baseline distortions by removing emergency spending from budget baselines to prevent temporary emergency funds from inflating long-term spending projections and creating a bias toward higher spending.

- Justify and track emergency spending by mandating that lawmakers provide justification for new emergency designations and requiring annual tracking of these costs to strengthen fiscal oversight.

It’s time for Congress to break the cycle of reactionary disaster deficit spending. Pairing emergency relief with these substantive reforms would ensure that taxpayer dollars are used in a more responsible and effective manner. The current knee-jerk reaction to every disaster that involves passing a blockbuster supplemental spending package is unsustainable in an environment with diminishing fiscal space. Congress needs a forward-looking approach that promotes personal responsibility, market-driven risk management, and stringent fiscal oversight.